Bristol council tax rebate: when will I get £150 payment, how to apply and claim, and where to check band

and live on Freeview channel 276

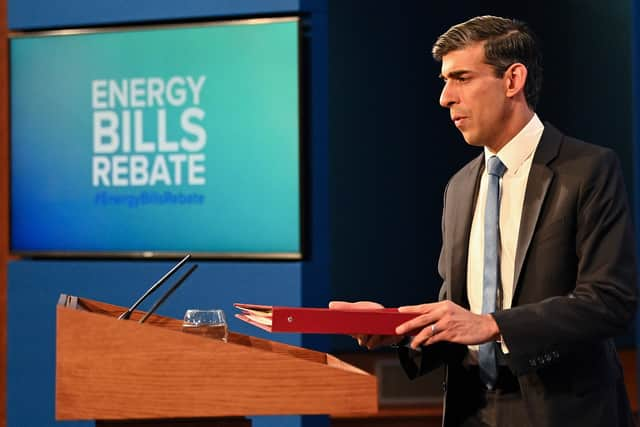

In a way to counteract the ongoing energy crisis that is having a widespread economic impact across the UK, the government revealed a number of measures in February designed to aid the most affected.

With Brits coming out of Covid-19 related lockdown measures, demand for energy has surged which has resulted in its price increasing substantially.

Advertisement

Hide AdAdvertisement

Hide AdOne measure that aims to alleviate these concerns is a £150 payment that a number of households across Bristol will be eligible for.

In the last 12 months alone, the cost of gas has more than quadrupled and the average UK household will see bills rise by £2,000, according to experts.

So if you think you might qualify for the tax rebate and want to take advantage of it, here is everything you need to know:

What is the council tax rebate?

The government is offering a one-off payment of £150 to eligible beneficiaries across the United Kingdom.

Advertisement

Hide AdAdvertisement

Hide AdThis is expected to be paid out in April - the month that the energy price cap is set to increase by £693 to £1,971 for more than 22 million households.

You will not need to repay the rebate and it will not be treated as income for tax or benefit purposes - it is limited to one per eligible household.

To find out more about the energy rebate scheme, visit the government’s official website.

Who is eligible for the council tax rebate?

In order to qualify for the rebate, you must be liable for Council Tax.

Advertisement

Hide AdAdvertisement

Hide AdYour household must also be within the tax bands A to D on April 1, 2022.

Band E households are also eligible but have an alternate band D valuation as a result of the disabled band reduction scheme.

An eligible household must be a chargeable dwelling, or within these following categories: N (occupied by students) ; S (occupied by residents under the age of 18) ; U (occupied by residents who are severely mentally impaired) and W (one of two dwellings in a single property occupied by a dependant relative of a person living in another dwelling in the property)

How will the council tax rebate be paid?

Bristol City Council are yet to reveal details of the tax rebate, but a large majority of councils across the country have adopted similar measures.

Advertisement

Hide AdAdvertisement

Hide AdThe £150 rebate will be paid directly into your bank account, but only if you pay Council Tax through a direct debit.

If you do not currently make tax payments through direct debit, click here to set it up online.

This method is also adopted by North Somerset Council, which is only a short drive from Bristol.

When will the council tax rebate be paid?

Local authorities across the country are expecting to start the roll out of the £150 council tax rebate today (21 April).

Advertisement

Hide AdAdvertisement

Hide AdThis will be received through direct debit, so no action is necessary - those who do not pay their tax through direct debit should be contacted in due course.

What if I am ineligible for the council tax rebate?

If you find that you are ineligible for the £150 rebate, the government has provided £144 million to councils across the country to provide support.

This will be given out via a discretionary fund, which also has certain criteria that is set to be revealed in the coming weeks.

What has Bristol City Council said?

BristolWorld reached out to Bristol City Council, who made this following statement:

Advertisement

Hide AdAdvertisement

Hide Ad“We are currently making arrangements to implement the scheme and will make further information available on our website as soon as possible.

“Households in council tax bands A-D will receive the £150 council tax rebate, but second homes or empty properties will not benefit,” it reads.

“For people who pay council tax by direct debit the rebate, which is expected to be made in April, will in most cases go directly into their bank account.

“Where additional information is needed to make this happen we will be in touch to request it.

Advertisement

Hide AdAdvertisement

Hide Ad“If you don’t already pay by direct debit we would recommend that you register to do so on our website as this will make sure the rebate is paid to you quickly.

“If you do not pay council tax by direct debit we will confirm as soon as possible how you can claim.”

How to check your tax band

You can check your Council Tax band online at GOV.uk.

You can also find this out on your annual bill which is sent to you in March 2022.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.